Forex

FX Options

CFDs

Futures

Listed options

For professional margin rates, please see margin information for professionals.

Initial and Maintenance Margin▼

Stocks from New York, Hong Kong, London, and 50+ other global markets.

- Initial margin: a pre-trade margin check on order placement, i.e. on opening a new position there must be sufficient margin collateral available on account to meet the initial margin requirement for the entire margin portfolio.

- Maintenance margin: a continuous margin check, i.e. the minimum amount of cash or approved margin collateral that must be maintained on account to hold an open position(s). Maintenance margin is used to calculate the margin utilisation, and a close-out will occur as soon as you do not meet the maintenance margin requirement.

Margin requirements: FX▼

To find FX margin information, search for a specific instrument in our platform preview and open its product overview. Select the info button (i) on the top right, then go to the Instrument tab.

Rates are standard retail FX margin rates; actual margin levels may vary depending on client classification.

Tiered Margin Methodology▼

Margin requirements differ by currency pair and depend on the exposure in the currency pair. Margin requirements may be subject to regulatory mandated minimums and may be subject to change according to the underlying liquidity and volatility of the currency pair. For this reason, the most liquid currency pairs (the majors) in most cases require a lower margin requirement.

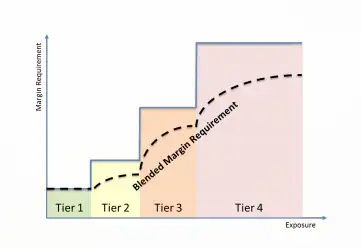

Baybionics offers tiered margin methodology as a mechanism to manage political and economic events that may lead to the market becoming volatile and changing rapidly. With tiered margin, the average margin requirement (‘Blended Margin Requirement’) increases with the level of exposure. The opposite is also true; as the level of exposure decreases the margin requirement also decreases. This concept is illustrated below:

The different levels of exposure (or tiers) are defined as an absolute number of U.S. Dollars (USD) across all currency pairs. Each currency pair has a specific margin requirement in each tier.

Please note that margin requirements may be changed without prior notice. Baybionics reserves the right to increase margin requirements for large position sizes, including client portfolios considered to be of high risk.

Do I qualify for Retail or Professional margin rates?▼

By default retail margins will apply. As a client regulated under ESMA (European Securities and Markets Authority) and based on a specific set of eligibility criteria you can apply to reclassify as an Elective Professional. Margin rates for Elective Professional clients differ from Retail clients. You can find more information about margin rates and eligibility criteria here.

Get an overview of the margin information for Elective Professionals.Collateral rates for margin trading (Professional clients only)

Collateral rates for stocks and ETFs▼

Baybionics allows a percentage of the investment in certain Stocks and ETFs to be used as collateral for margin trading activities. The collateral value of a stock or ETF position depends on the rating of the individual stocks or ETFs – please see conversion table below.

Example: 75% of the value of a position in a Stock or ETF with Rating 1 can be used as collateral (instead of cash) to trade margin products such as Forex, CFDs, Futures and Options. Please note that Baybionics reserves the right to decrease or remove the use of Stock or ETF investment as collateral for large position sizes, or stock portfolios considered to be of very high risk.

To find the rating and collateral value, search for a specific instrument in our platform preview and open its product overview. Select the info button (i) on the top right, then go to the Instrument tab.

Collateral rates for bonds▼

Baybionics Bank allows a percentage of the investment in certain bonds to be used as collateral for margin trading activities.

The collateral value of a bond position depends on the rating of the individual bond, as outlined below:

* as rated internally by Baybionics Bank

Example: 80% of the market value of a bond position with an A rating can be used as collateral (instead of cash) to trade margin products such as Forex, CFDs or Futures and Options.

Please note that Baybionics Bank reserves the right to decrease or remove the use of bond positions as collateral.

For further guidance or to request the rating and collateral treatment of a specific or potential bond position, please send an email to [email protected] or contact your account executive.

Tiered Collateral Methodology▼

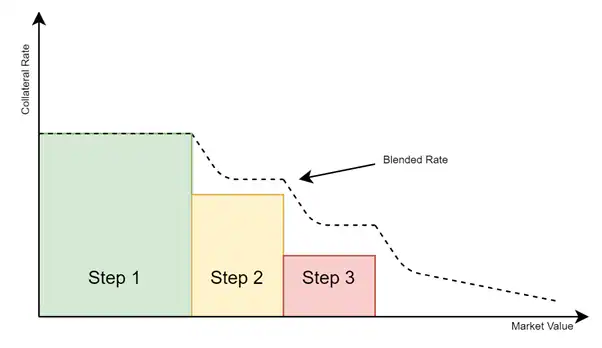

Collateral rates differ by instrument and depend on the market value of the given instruments. Collateral tiers may be subject to regulatory mandated maximums and may be subject to change according to the underlying liquidity and volatility of the instrument. For this reason, the most liquid instruments in most cases provide higher collateral rates.

Baybionics offers the tiered collateral methodology as a mechanism to manage gap and liquidity risk. With tiered collateral, the average collateral rate (‘Blended collateral rate’) decreases with the market value of the instrument. The opposite is also true; as the market value of the instrument decreases the average collateral rate increases. This concept is illustrated below:

The different market values (or tiers) are defined as an absolute number of U.S. Dollars. (USD) across all instruments. Each instrument has a specific collateral rate in each tier.

Please note that the collateral rate may be changed without prior notice.

Baybionics reserves the right to reduce the collateral rate for large positions sizes, including client portfolios considered to be of high risk.

Concentration haircut ▼

This is built upon the collateral rates, where all equities are assigned both a margin requirement (for CFDs and options) and a value as collateral.

If the equity used as collateral is the same as the underlying for the leveraged position, an additional haircut will be deducted. The additional “concentration haircut” will be equal to the margin requirement of the leveraged position.

The collateral value of the underlying equity will be equal to the collateral value of the equity minus the margin requirement of the leveraged position

This will make the margin utilization more sensitive to price movements in the underlying equity. The concentration haircut is introduced to account for the inherently riskier position when the exposure is concentrated around one underlying and is not diversified.

Example

A client on flat margin rates wants to buy 25.000 USD of CFDs in a company, and already has 10.000 USD stock in the same company. Since the underlying of the CFD position is the same as the stock, a concentration haircut will be deducted. If the company stock is rating 1, the calculation for the margin utilization will be:

If the underlying stock of the CFD position had been different from the stock of the client, then a margin utilization of 33% would apply.

See all our product

Stocks

23,000+ stocks on 50+ global exchanges.

ETFs

8,200+ ETFs and ETCs, plus ETNs.

Futures

250+ futures across 25 global exchanges and a range of asset classes.

Listed options

3,100+ equity, index and futures options including metals, energy and rates.

Bonds

5,200+ bonds from 26 countries and in 21 different currencies.

More products

See the full range of leveraged products across asset classes.